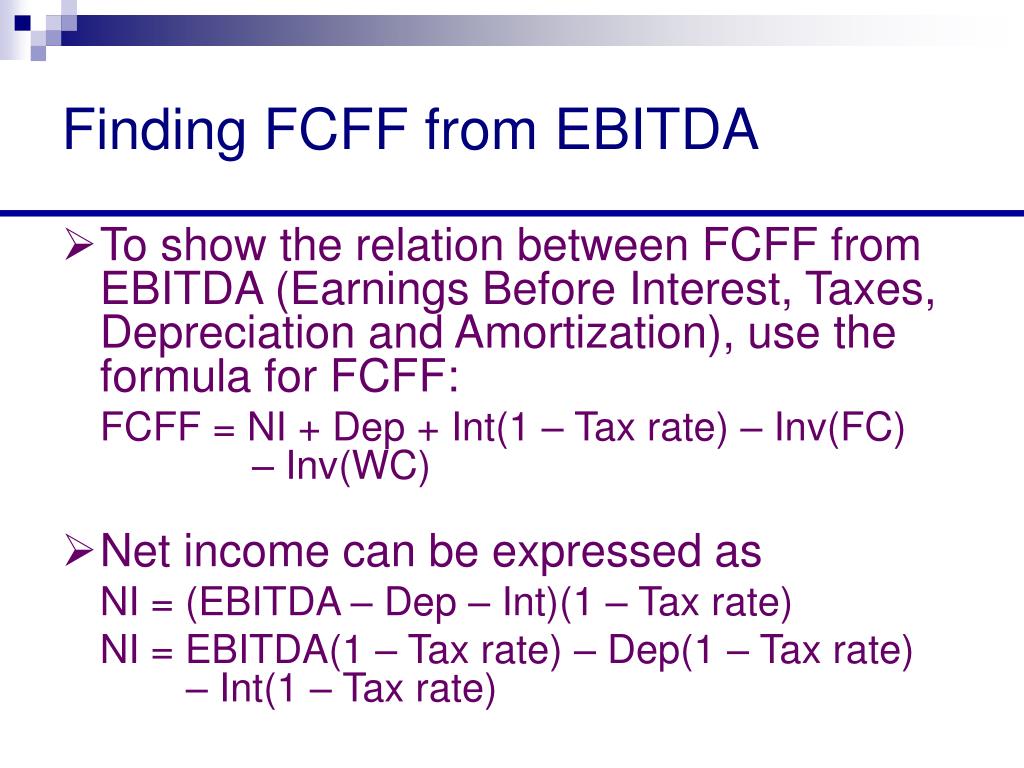

The value business value, as the sum of the discounted FCFF, is: 417.664 EUR. Since there are two forms of capital it is easy to understand the relation between business value and equity value: By using the FCFF you will reach to the business value, using the FCFE while bring you to the equity value. Valuing a company or project by FCF, FCFE or FCFF is not completely the same, nor does it use the same assumptions (despite being similar). The FCF may be a reference to either the FCFF or the FCFE without any particular discrimination of which. It is important to always take in consideration the distinction between FCF, FCFF and FCFE, as it can induce in errors. FCFE (Free Cash Flow to Equity) – the cash flows that are only available for the equity holders.īecause there may be different grades of equity holders, just consider that the FCFE corresponds to the holders of ordinary capital.FCFF (Free Cash Flow to the Firm) – the cash flows that are available for both the debt holders and the equity holders.

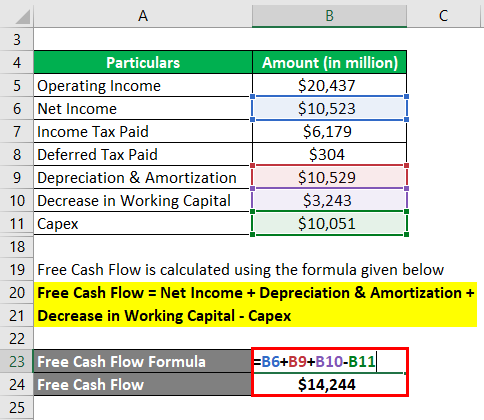

Since there are two types of holders of capital (equity holders and debt holders), the FCF of a firm is commonly calculated under two perspectives: The income statement only presents the revenues and expenditures it does not identify the entries and withdrawals of cash and, on top of it, the income statement includes items that do not represent any cash movement, as is the case of the depreciations. Subtract capital expenditures (CAPEX) or the.

#FREE CASH FLOW FORMULA EBIT FREE#

The cash flows are the economic benefits of those who have invested in the company. Calculating free cash flow Start with the companys operating cash flow (OCF) from its cash flow statement. The FCF is the cash that the company makes available for the holders of the company’s capital through its operational, financing and investment activities. The solution is to use the economic benefits that the company generates: the Free Cash Flow (FCF). Hence, in most situations (specially in private companies) the economic benefits of capital holders cannot be directly inferred by either the net income or by the dividends that the company pays. Add back the company’s Depreciation & Amortization, which is a non-cash expense that reduces its taxes but which does not cost it anything in cash in the current period. Multiply by (1 Tax Rate) to get the company’s Net Operating Profit After Taxes, or NOPAT.

0 kommentar(er)

0 kommentar(er)